A quick guide to first time buyer programs in texas. Using a real estate agent can help for some and after deciding whether to use one or not, the next step after finding your new production home is applying for a mortgage.

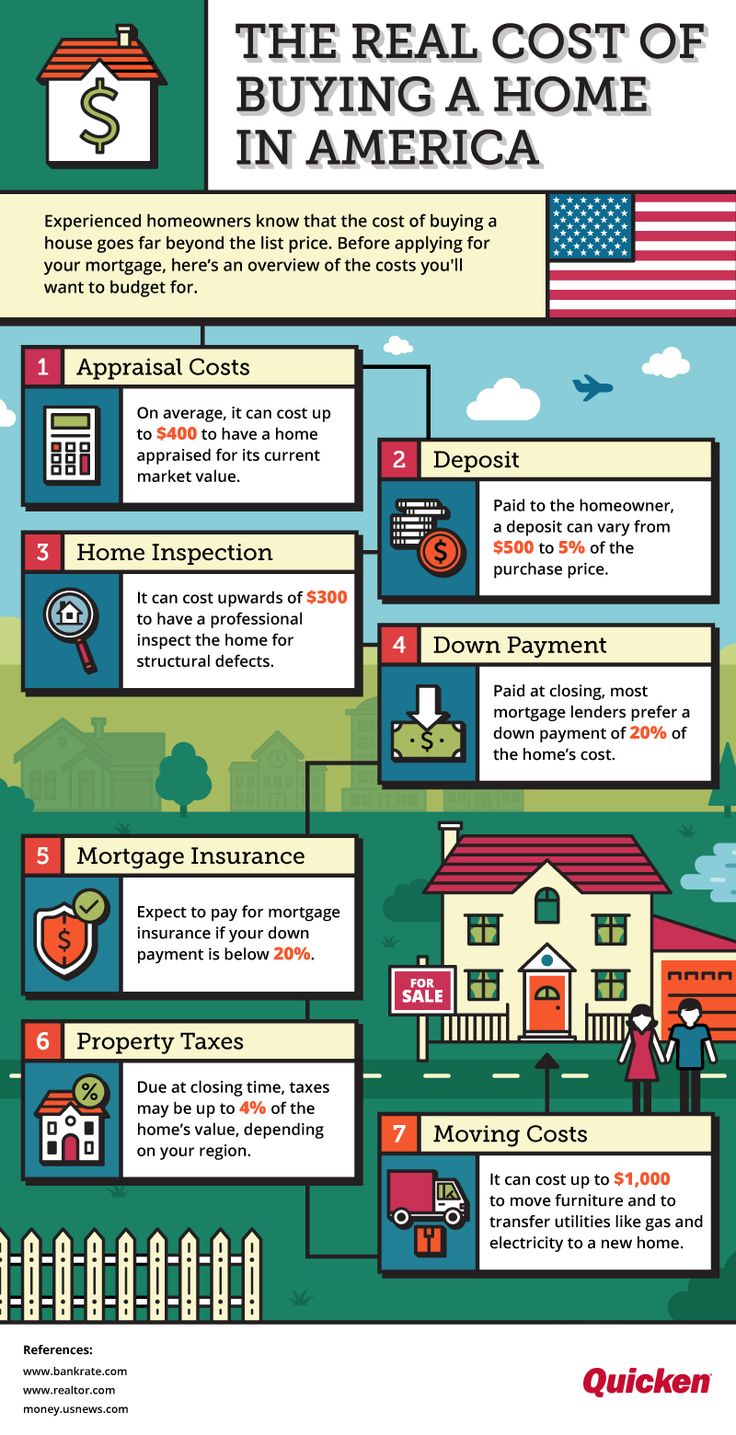

Many people still think you need a 20 down payment in

Many people still think you need a 20 down payment in

Tdhca doesn’t actually grant loans and assistance directly.

First time home buyer guide texas. First time home buyer programs. Texas first time home buyer options almost everything changed in 2020 thanks to the pandemic, but there are some things that never change: “fico scores ignore [mortgage] inquiries made in the 30 days prior to scoring,” according to myfico.

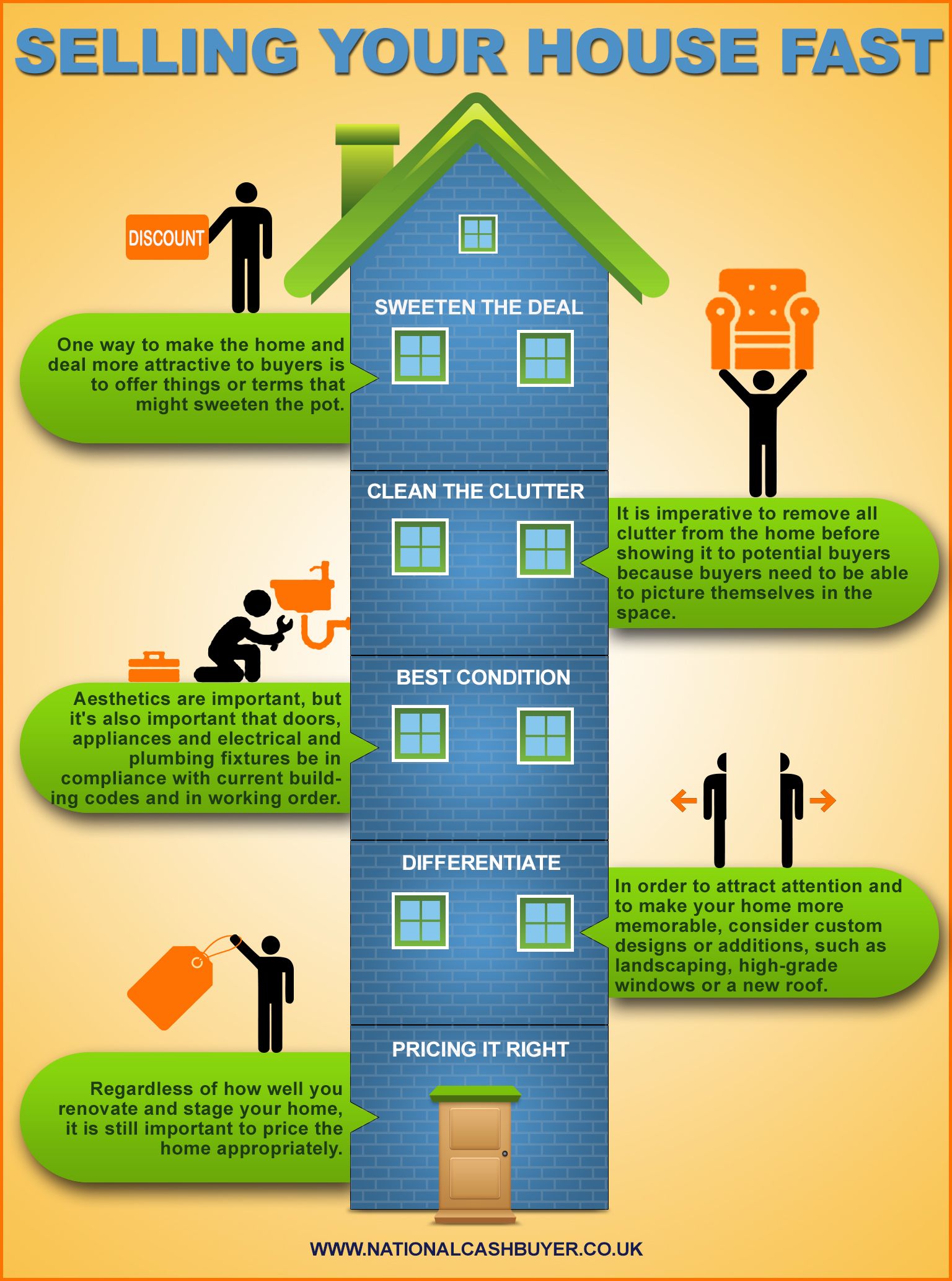

Not only are you getting out of the rental market, but you’re investing in your future. Buying a home is one of the most exciting—and daunting—things you'll ever do. Luckily, there’s a comprehensive first.

As your real estate agent. Where do i get started? Buying a home is still considered a key aspect of the american dream.

It pays to have an expert and a friend in your corner. How to set and stick to a budget ; My first texas home program.

There are often additional benefits, or even entirely separate programs, for educators, protectors, health care workers, veterans of the armed forces, and households with disabled members. Luckily, the first time home buyer guide from realtor.com® is here to help. At houstonproperties, we offer one of houston’s best free first time home buyer’s kits.

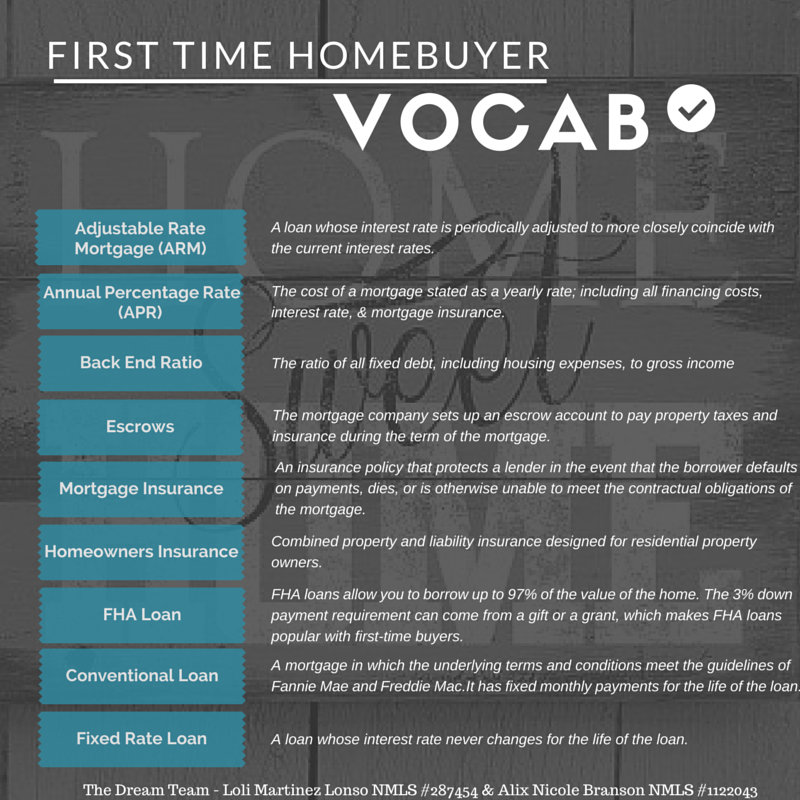

* the applicant is a first time home buyer, veteran, or home buyer who has not owned a home within the past three years * must meet income limits for your county * must meet purchase price limits * minimum credit score of 620 * other requirements may apply. We will help you define your wish list of features you want in your home, your neighborhood. A home buyer education course will provide information on a variety of topics related to the home buying process.

Are you a first time home buyer? We will lead you through every step of the exciting home buying process. 5 first time home buyer mistakes.

The best place to get started is to get pre approved for a mortgage loan. You must be a first time home buyer in texas. Department of hud 2019 annual report

Whatever the challenges, chances are, we’ve seen it and can help. Your decision to buy a home is both a sound financial decision and a commendable achievement. Please email paige martin for your copy.

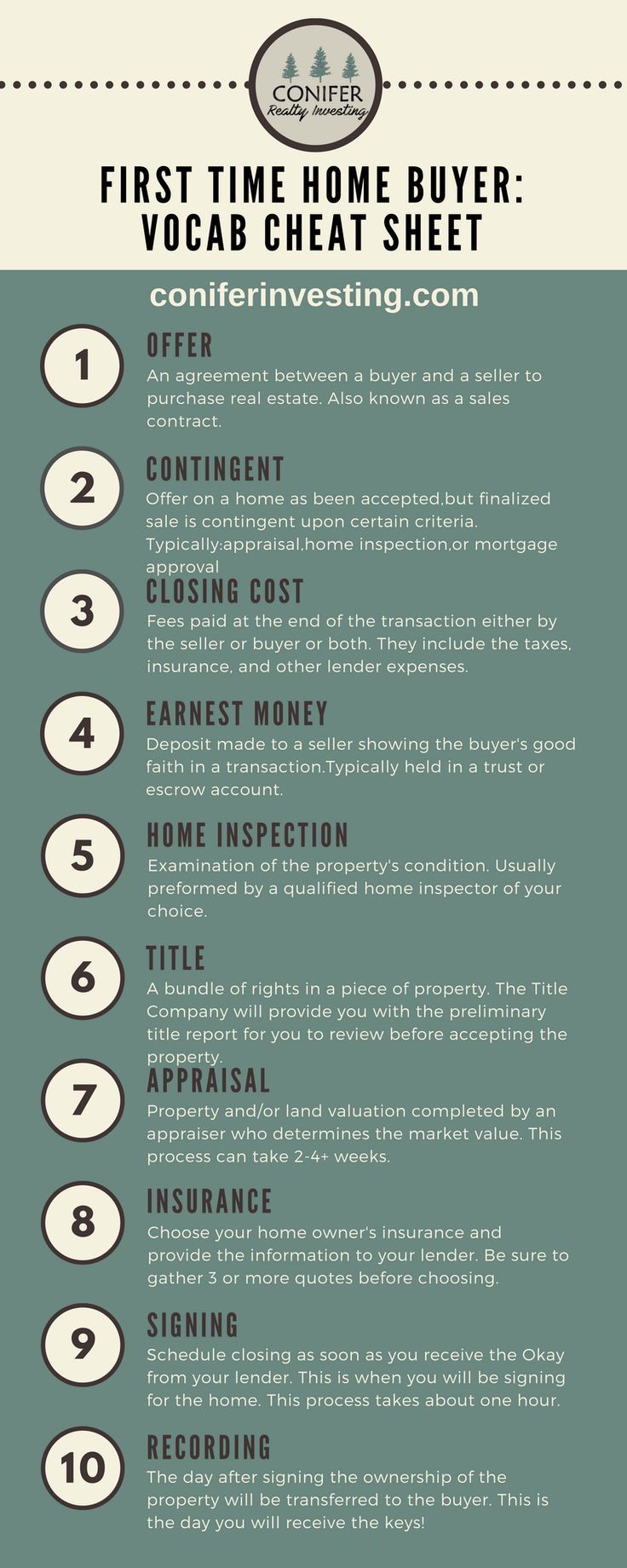

This article answers some of the most important and common questions for a first time home buyer. If you are reading this, you are likely among the majority who consider owning a home among their dreams, but in order for the purchase to be a satisfying and enjoyable experience it was meant. In a recent survey, 74% of americans said homeownership was part of achieving their personal american dream.

Our success guide for a first time home buyer answers these questions: The good news is you don’t have to settle for the first offer that comes your way out of fear that your credit score will take a hit. When buying your first home, information is your key to success.

Alongside your tdhca mortgage loan, you’ll also receive a 0% interest second loan to help you cover the upfront costs of buying a home. First time home buyer guide: You only have to pay it back when you sell, refinance or pay off your mortgage.

Buying a home for the first time is a huge step. Down payment and closing cost assistance is available for up to 5 percent of the mortgage loan.