Safety concerns (rust, nails, etc.) stained, torn, and/or damaged; The potential savings here are likely greater than what a liquidator would pay for those same goods.

Baby Furniture Donations Best Interior House Paint Check

Baby Furniture Donations Best Interior House Paint Check

We suggest you contact your tax adviser or accountant or visit the irs website for more information.

Donation value guide habitat for humanity. Donation value guide calculator goodwill donation spreadsheet template 2017 goodwill donation value guide 2017 spreadsheet habitat for humanity donation value guide 2016 irs donation value guide 2017 itemized donation list printable 2017 turbo tax donation value guide value of donated costume jewelry. Habitat for humanity international is a 501(c) (3) nonprofit organization. Window units.less than 7 years old

This guide is not all inclusive and may not recognize special circumstances. Habitat for humanity is a nonprofit christian organization revolved around the importance of providing living opportunities for paycheck to paycheck families of all races, religion, culture, and… All appliances must be in 100% working order and must be clean with all knobs present.

Let's create a partnership to address your future business needs. Beverly bird—a paralegal with over two decades of experience—has been the tax expert for the balance since 2015, crafting digestible personal finance, legal, and tax content for readers.bird served as a paralegal on areas of tax law, bankruptcy, and family law. If you would like to provide financial support to assist with habitat for humanity's endeavors you can do so online, by telephone, or by mail.

Prices are only estimated values. Habitat for humanity is a 501(c)(3) nonprofit organization. When you donate inventory, you may be able to receive significant tax credits for the value of your donation.

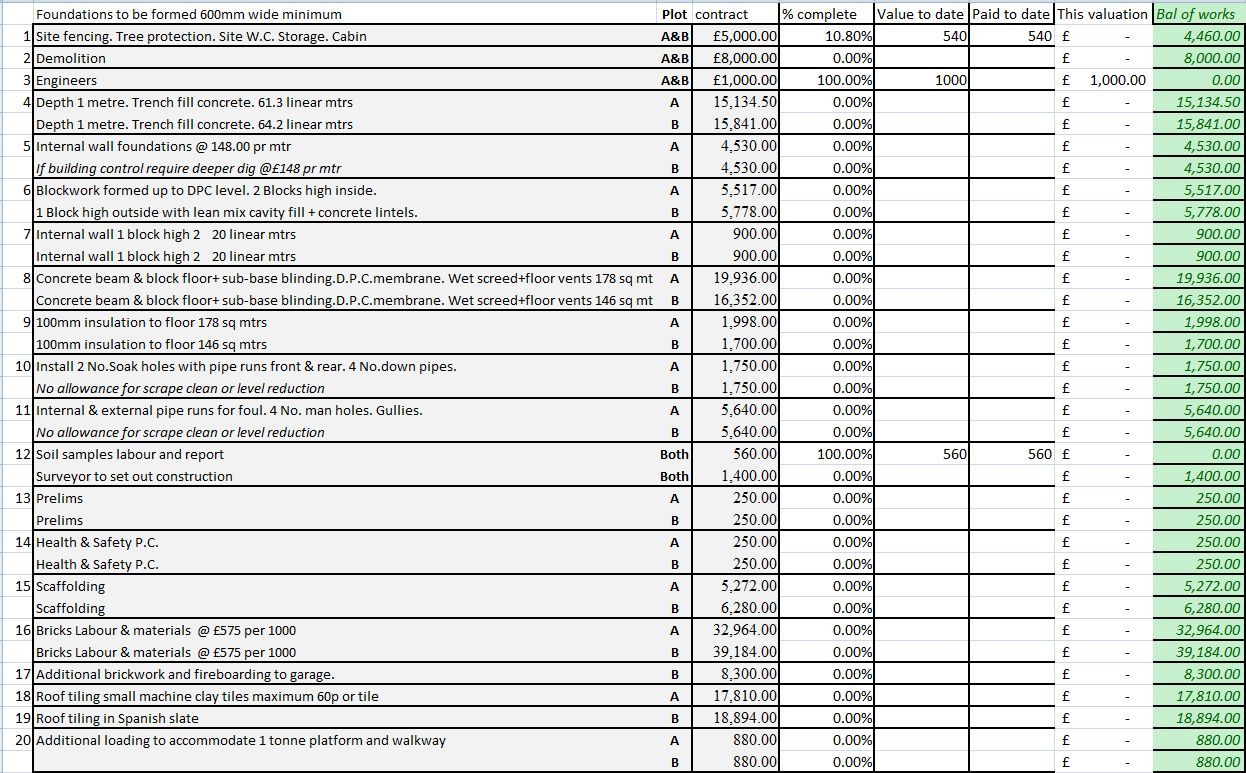

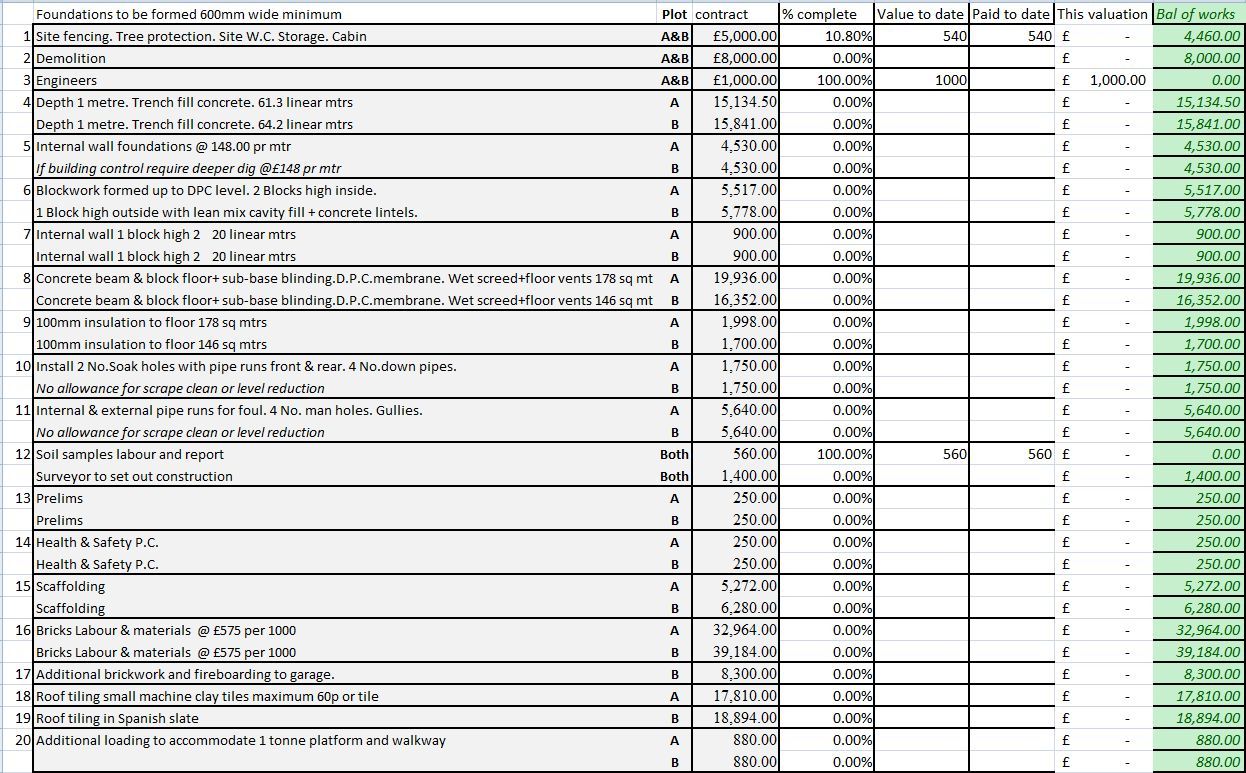

It includes low and high estimates. Habitat for humanity donation value guide 2017. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

If you itemize deductions on your income tax return, it may be possible to claim a deduction for your car donation. We would be happy to take a variety of the items in your home as donations to support habitat for humanity, but unfortunately we do not offer a service to help you sort through everything. Make them reusable by making templates, add and complete fillable fields.

This guide is not all inclusive and may not recognize special circumstances. Below is a handy guide from habitat for humanity. Internal revenue service (irs) requires donors to value their items.

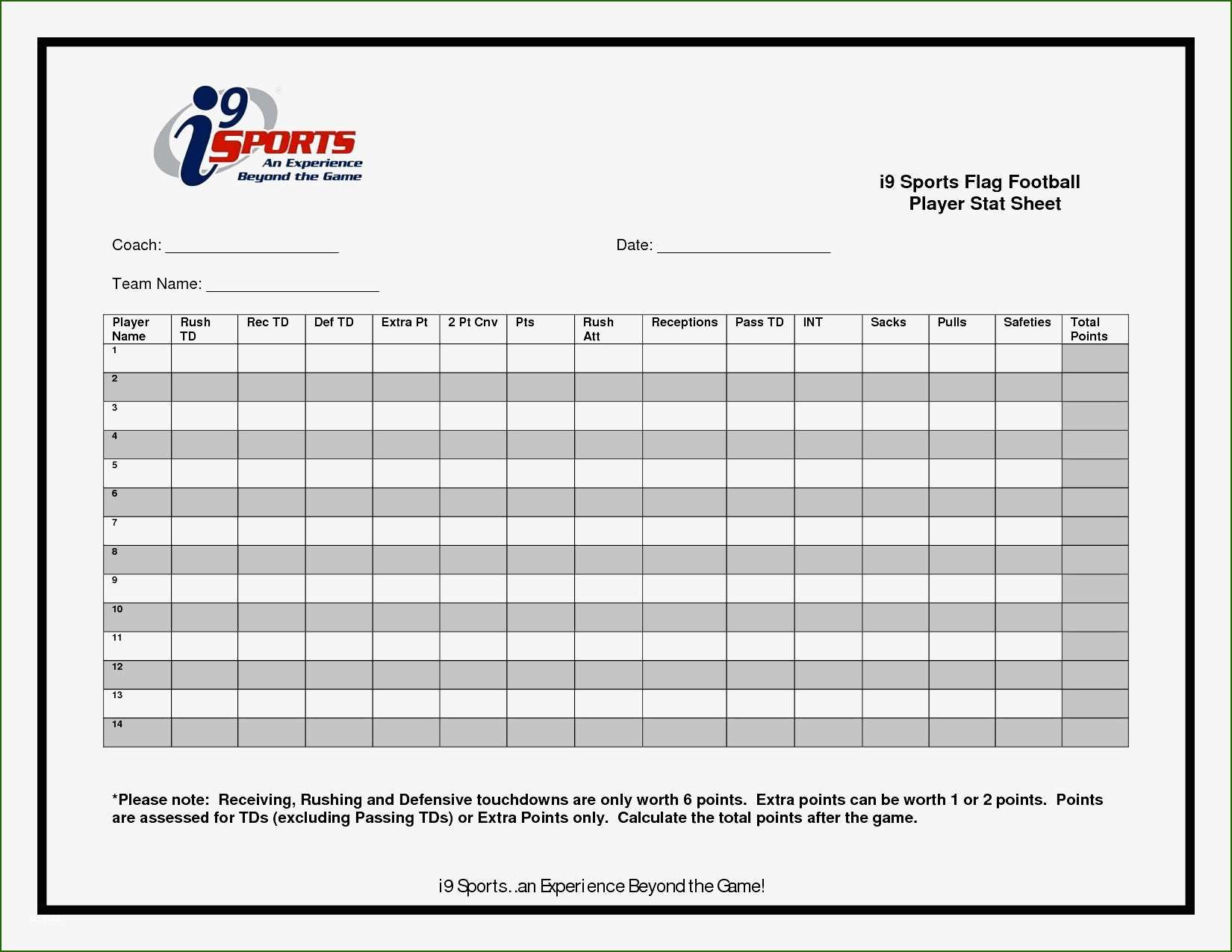

You will see that the table includes low and high estimates of value. Donation valuation guide the following list of typical restore items reflects a suggested range value for determining income tax deductibility. Please include any owners’ manuals if you have them, as they add value to your donation.

Treat them according to the condition they are in when you donated them. All the revenue supports habitat’s mission to eliminate poverty housing from the twin cities and make decent, affordable housing for all people a matter of conscience. In 2005 the irs changed the laws related to tax deductibility of vehicle donations because of exaggerated deductions based on inflated book values (book.

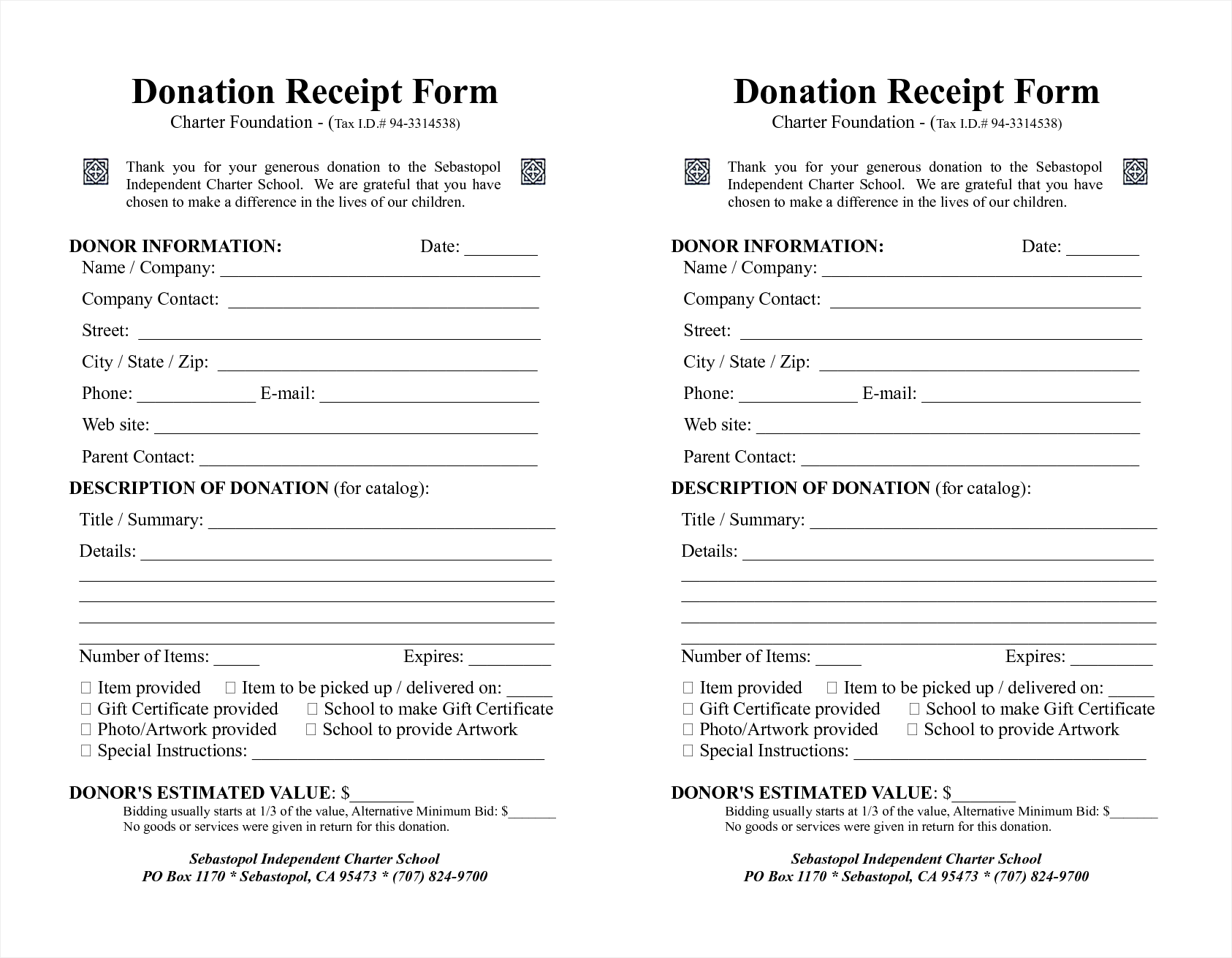

If you donated unused items, then value them at the top of a range. A receipt for the contribution(s) should be kept in the event of an irs audit. Mon valley habitat for humanity reserves the right to decline a donation based on criteria and policies enacted to ensure the safety of our donors, volunteers, and staff.

Please choose a value within this range that reflects your item's relative age and quality. Complete documents electronically using pdf or word format. We will be sure to provide you with a tax donation receipt for the value of your donation.

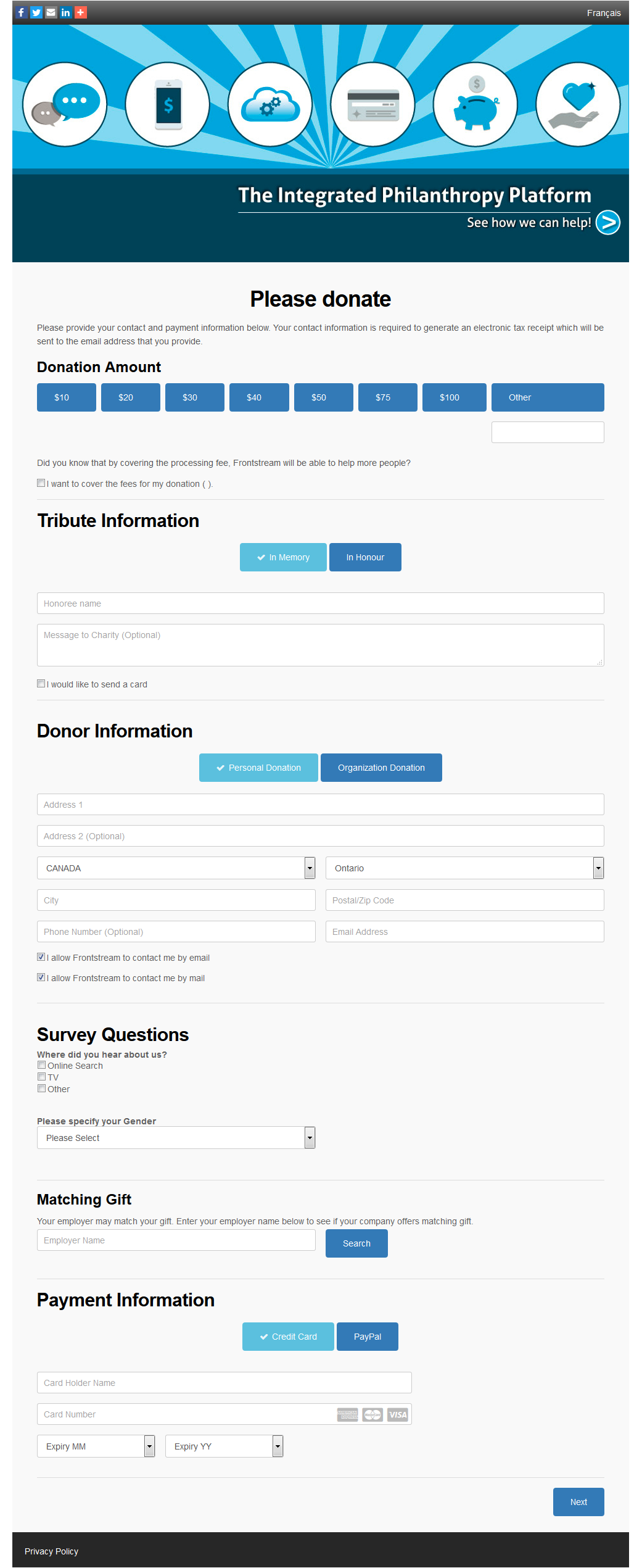

Making financial donations to habitat. Visit the secure online donation page to give money via the website. As a registered nonprofit, habitat for humanity can provide the necessary paperwork to claim the value of the donation.

Contributions, including vehicle donations, may be claimed as deductions on your federal tax return if you itemize on schedule a of form 1040. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published. If the items have been used, then the value would be on the lower end of the range.

How much can i deduct? Faced with this moment of national urgency and entrusted by communities to lead in crisis, we affirm and commit to utilizing these principles and values as a guide in our individual and collective efforts to advance equity and justice. In order to receive a tax deduction, contributions must be itemized in order to lower your taxable income.

Item does not work as intended; The habitat for humanity donation receipt is a legal note detailing the contribution of home goods to a habitat restore, which is a 501(c)(3) charity. Twin cities habitat for humanity restore.

It is up to the donor to determine the value for tax purposes. Once cars for homes sells your vehicle, the selling price becomes the amount of your donation. Donation valuation guide revised 5/09 the value guide below will assist you in determining the tax‐deductible value of any used items you are donating to the habitat for humanity restore.

Donation valuation guide the following list of typical restore items reflects a suggested range value for determining income tax deductibility. Guide for goodwill donors the u.s. Assume the following items are in good condition, and remember:

Approve forms using a lawful electronic signature and share them through email, fax or print them out.